Tired of navigating the conservative requirements of traditional financial providers? Private lending provides an alternative that empowers you to realize your dream home, even with unique circumstances. Private lenders tend to consider factors beyond just your credit report, giving you a greater chance of funding .

- Exploit your possessions

- Secure financing

- Master challenging transactions

Embarking on a path to homeownership doesn't have to be daunting . Private lending can open the possibilities to your dream home, allowing you to build a stronger financial future.

Private Home Loans: Flexible Financing for Unique Needs

When it comes to financing your ideal home, traditional financing options may not always meet your specific circumstances. This is where private home loans can step in and offer a solution for those seeking more flexible financing terms. These loans are often offered by private investors, allowing them to be more adaptable than conventional mortgages.

Whether you're dealing with non-standard credit history, require a more substantial down payment, or need funds for a particular property type, private home loans can provide the capital you need to make your homeownership goals achievable.

It's important to remember that private home loans often come with uncommon terms and conditions compared to traditional mortgages.

Therefore, it's crucial to meticulously research your options, evaluate lenders, and understand the full implications of any loan agreement before you commit.

Explore the Market with a Private Mortgage Lender

In today's dynamic real estate market, finding the right funding can be a obstacle. Traditional lenders often have rigid requirements that may prevent some borrowers from accessing mortgages. This is where private mortgage lenders step in. These alternative lenders offer flexible financing solutions that can be a advantage to buyers who may not fit with traditional lending. A private mortgage lender's understanding of niche markets and individual situations allows them to extend unique terms that can have a significant impact in your property acquisition journey.

- Consider private mortgage lenders when you have special financial needs

- Enjoy more lenient lending guidelines

- Obtain a loan faster with a simplified application process

Customizable Mortgages for All Scenarios - Exclusive Refinance Programs

Finding the ideal mortgage solution can be a tricky process, especially if your financial profile is non-traditional. Praisefully, there are customized mortgage options available that cater to a varied situations. Private refinance solutions offer adaptability and innovative lending methods that can help you realize your homeownership dreams.

Whether you're facing challenges with traditional lenders, need a flexible payment plan, or simply want to explore improved interest rates and terms, private refinance solutions can provide a valuable path forward.

Let's how these unique mortgage options can benefit you in securing your homeownership aspirations.

{

A key advantage of private refinance solutions is their ability to accommodate a wider range of credit profiles and financial histories. Unlike traditional lenders who often have formidable lending criteria, private lenders are more willing to working with borrowers who may not satisfy the conditions for conventional mortgages.

{

Moreover, private refinance solutions offer a greater degree of adaptability when it comes to financing arrangements. This means you can tailor a mortgage plan that aligns with, taking into account your current situation.

{

It's important to remember that private refinance solutions are not one-size-fits-all. It's essential to carefully research different lenders and compare financing programs before making a decision.

Unconventional Lending Solutions: Explore the World of Private Mortgages

Navigating a mortgage landscape can be a daunting process, especially when traditional financing options fall short. For borrowers seeking unconventional solutions, private mortgage programs offer an intriguing route. These specialized lenders commonly operate beyond the realm of conventional banks, offering tailored {financialarrangements that may be better suited for specific circumstances.

Private mortgages check here can prove particularly beneficial for individuals facing uncommon financial situations, such as independent contractors. These lenders often assess a broader range of criteria beyond just credit scores and income, recognizing assets, business history, and other applicable information.

- Additionally, private mortgages often involve more versatile terms, such as variable loan structures that can shift over time. This flexibility can be advantageous for borrowers who anticipate upcoming changes in their financial standing.

- However, it's important to recognize that private mortgages typically feature higher interest rates and fees compared to conventional loans. Borrowers should carefully analyze all terms and conditions before entering into a private mortgage agreement.

Speedy, Courteous & Flexible: Private Mortgage Refinancing Made Easy

Are you ready to unlock the potential of a diminished interest rate? Discover the advantages of private mortgage refinancing with our passionate team. We offer customizable solutions to meet your individual needs, making the process easy.

Our transparent communication and efficient procedures ensure a effortless experience. From starting consultation to final paperwork, we're here every step of the way to guide you.

With private mortgage refinancing, you can:

* Decrease your monthly payments

* Strengthen equity faster

* Tap into cash for home improvements or other goals

Don't let high interest rates hinder your progress. Reach out to us today for a free consultation and explore how private mortgage refinancing can improve your financial future.

Scott Baio Then & Now!

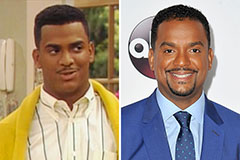

Scott Baio Then & Now! Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Michael C. Maronna Then & Now!

Michael C. Maronna Then & Now! Marcus Jordan Then & Now!

Marcus Jordan Then & Now! Barbara Eden Then & Now!

Barbara Eden Then & Now!